does texas have a death tax

Specifically on February 16 2021 Prop. No not every state imposes a death tax.

Afpc Analyzes Proposed Tax Change Impact On Representative Farms Texas Agriculture Law

However localities can levy sales taxes which can reach 75.

. Only 12 states plus the District. Then the estate must pay the taxes interest and penalties. Then the estate must pay the taxes interest and penalties.

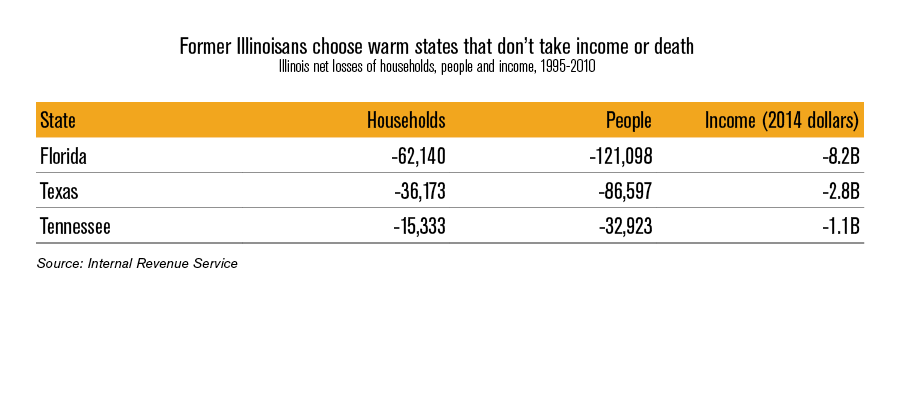

Texas also does not have an estate tax. Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas.

There is a 40 percent federal tax however on estates over 534. There is a Federal estate tax that applies to estates worth more than 117 million. No estate tax or inheritance tax Alaska.

Death Taxes in Texas. So a married couple gets two step-ups one at the time of the first spouses death and another at the time of the second spouses death. No estate tax or inheritance tax Arkansas.

Higher rates are found in locations that lack a. Inheritance and estate taxes are often grouped under the label death taxes Texas repealed its inheritance tax on September 15 2015. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

There is a 40 percent federal tax however on estates over 534. Then the estate must pay the taxes interest and penalties. The taxes plus interest plus a penalty keep adding up until the elderly or disabled homeowner dies.

19 went into effect resurrecting a death tax on property that voters had eliminated back in 1986. Does every state impose a death tax. Texas repealed its inheritance tax law in 2015 but other.

There is a 40 percent federal tax however on estates over 534. Alaska is one of five states with no state sales tax. Prior to September 15 2015 the tax was tied to the federal state.

Today one year later thousands of. No estate tax or inheritance tax California. Texas does not have an.

No estate tax or inheritance tax Arizona. Does texas have a death tax Friday July 1 2022 Edit. So long as the decedents estate is valued at less than the applicable exemption amount for the.

State Estate And Inheritance Taxes Itep

Texas A M Study Tax Code Changes Would Devastate Family Farms

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Death Duty Or Inheritance Tax Reintroduced

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State Death Tax Chart Resources The American College Of Trust And Estate Counsel

Death Tax In Texas Estate Inheritance Tax Law In Tx

Talking Taxes Estate Tax Texas Agriculture Law

Will Inheritance Tax Be Due On My Family Member S Estate Ellisons Solicitors

Is There An Inheritance Tax In Texas

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

/cloudfront-us-east-1.images.arcpublishing.com/dmn/XON2HRNKLFDBLM6ZDNGOYDTUVQ.png)

Death And Taxes The Imperiled Federal Estate Tax Exemption

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

Texas Supreme Court Holds That A Beneficiary May Not Accept Any Benefit From A Will And Then Later Challenging The Will The Fiduciary Litigator